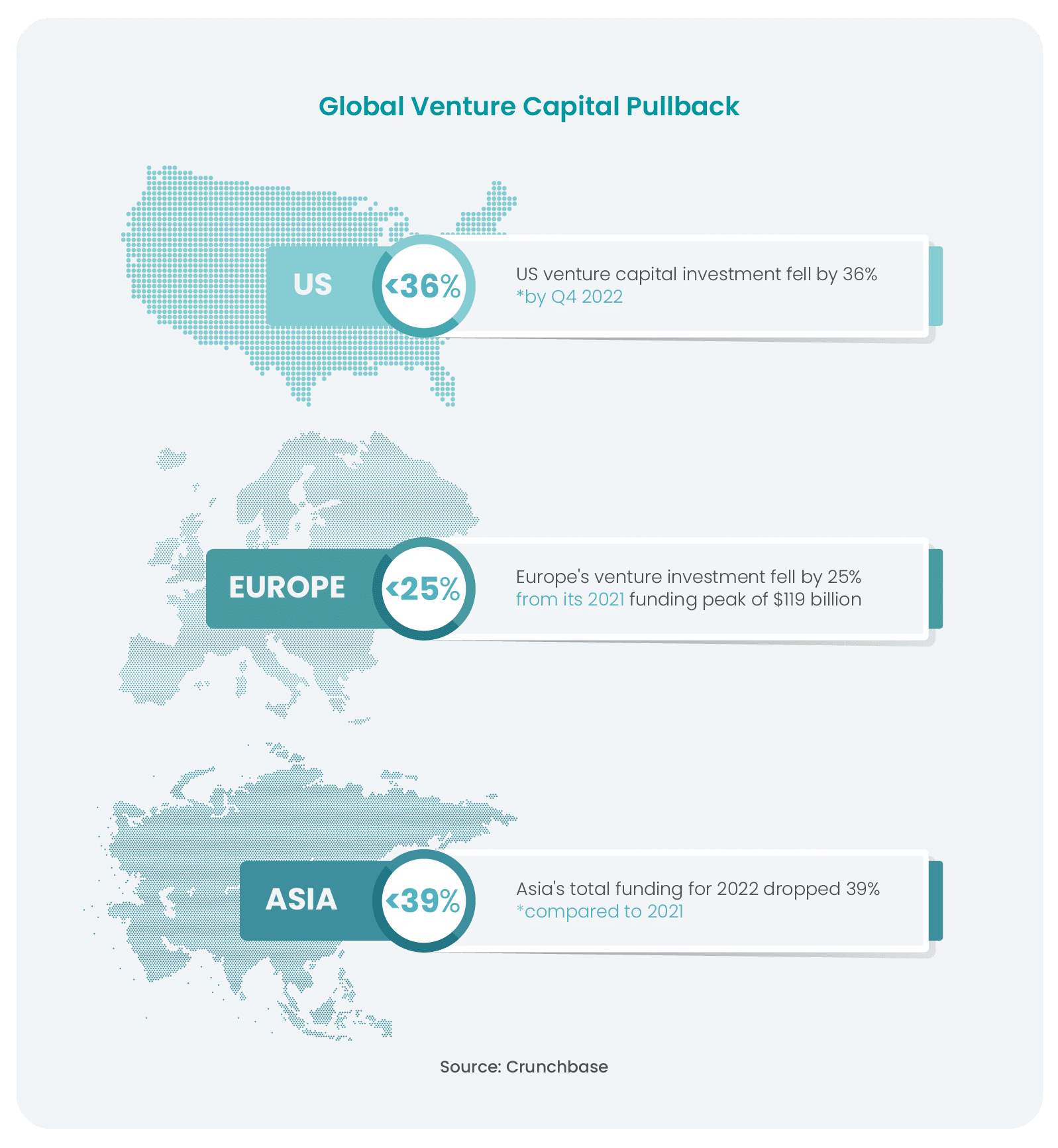

The investment landscape for startups in 2023 is a rapidly evolving, ever-changing environment. With venture capital (VC) investments in a steep decline across markets and regions by the end of 2022, we saw a venture capital pullback worldwide.

The competition for VC funding has become fierce, with investors looking to invest only in the most promising ideas. This means that entrepreneurs need to be strategic and well informed when it comes to their fundraising efforts if they want to succeed.

In this article we will explore how the VC pullback is shaping the startup investment landscape in 2023 and what entrepreneurs need to do to pitch their product to investors, stand out and consider new capital sources when securing funding.

Contents

The Result of the 2022 VC Pullback: a new Landscape for Startup Investment

The ongoing global venture capital pullback has been a major challenge for startups worldwide. With VC funding in decline, it has become harder to convince investors as VCs are looking for monetization more than ever and have become more selective in their startup investment. Adding to that, despite what you may think, there is no pressure to invest fast at this time for those VCs.

As a result, many businesses are scrambling to secure the funding they need to grow and expand their operations. Or, focus on Break-Even or profitability as fast as they can. This is not only seen in the big tech layoff, but across the industry. Some VCs are even encouraging early startups to cut costs and staff where possible to increase their runway. VC investment has long been seen and needed as a source of capital is deemed crucial for early as well as later-stage startups.

Despite the challenges presented by the global VC pullback, there are still opportunities available for those startups willing to put in the work and make connections with potential investors.

By understanding what investors are looking for and presenting a compelling idea and business plan backed up by hard data, entrepreneurs can still find success even during this difficult period of reduced VC investments. Monetization and having a certain level of maturity (paying users for instance) are being put high on the totem pole.

The Difficulties for Startups to Secure VC Funding

With the global venture capital pullback impacting all markets, it is harder to get funding – full stop. Last year’s high valuations and sky-rocketing, all-time-high funding rounds have changed into a competition for what is left of available VC funding. The need to become more capital-conscious and pitch sound strategies, which turn a great idea into a viable product, is a direct result of declining VC funding for startups.

According to Forbes, many investors, especially in Series B and beyond, are waiting to invest until valuations come down. CB Insights and Crunchbase both deliver reports that back the market mood. In late 2022, the median deal size dropped by more than 20%. A hard hit.

— from $10 billion in Q4 2021 to $5 billion [in Q4 2022]. The dramatic drop at an early stage is a signal that investors are adopting a wait-and-see approach to this market.“

But while investment is harder to get and the funding rounds may be smaller than in previous years, there’s still VC capital and other funding options available across markets and sectors. How can startups inspire confidence and attract investors in today’s market?

How Can Your Startup Appeal to VC Investors?

Securing VC investment can be a daunting task for startups in the current environment, but it’s not impossible. To stand out, entrepreneurs must be strategic and very well-prepared when approaching potential investors. The first step is to develop an effective business plan that outlines a clear vision.

If you can check the box of every step in this process, your chances of success in getting VC investment and succeeding against competitors is much higher. Ensure you have the right team in place to support your startup’s growth when VC funding comes in.

The global VC pullback has caused early stage and later-stage startups to look elsewhere for funding options. These alternative sources of capital can provide much needed funds, but entrepreneurs must consider them in detail before committing.

4 Investment Alternatives for Startups

For startups seeking capital, venture capital investment is not the only option. In fact, there are a variety of financing options available to entrepreneurs looking for alternative sources of funding.

Debt and Equity Crowdfunding

This allows companies to raise funds by taking loans from a crowd of lenders in exchange for interest payments. Equity crowdfunding enables businesses to sell shares in their company through an online platform in order to raise money from individual investors.

Angel investors

Angel investors provide early-stage investments for startups with high growth potential. This type of funding allows entrepreneurs to get a jumpstart on their business, enabling them to quickly turn their ideas into reality. Angel investors often bring more than just money to the table; they also offer guidance and mentorship through their experience.

These grants help fund research and development projects that have public benefit objectives. They can be used to develop new technologies, conduct pilot studies, or create innovative solutions to address important social issues.

Private or Public Funding

Private investors may be more likely to invest in a startup if they think it has potential for growth, whereas public funding may require the startup to meet criteria related to job creation or community development goals.

These alternatives can be just as beneficial when it comes to obtaining capital for a startup than VC investments. Ultimately, founders must decide which type of funding is best suited for their particular business idea, their needs and goals.

The VC Pullback: Effects on Startup Hiring

“Many startups are more careful in hiring. Despite that, and even more so today,

it is essential to hire the right people and team

to stay relevant and sell your idea to investors.“

Delano Brand, Director at Key Search

The global venture capital pullback we’ve seen in 2022 has had a major impact on the hiring of startups all over the world. With VC investments becoming more scarce, many businesses have had to adjust their recruitment strategies in order to stay afloat. Companies are now being forced to prioritize and identify the most necessary jobs.

The effects on startup hiring have been far-reaching. Startups have had to make difficult decisions to downsize, postpone hires, delay expansion plans, or even halt hiring altogether in order to remain financially viable. This is in stark contrast to the peak of VC investment in 2021-2022 when startups were actively recruiting and onboarding to scale… as fast as they could.

However, finding top talent and focusing your efforts on securing investments and taking your startup to the next stage will in turn result in an ability to expand your team and scale the business. You could say that hiring the right type of leader now has become even more critical.