Contents

Optimistic Vision for 2024: Crypto's Bull Market and Its Impact

At Key Search, our role as executive search consultants places us at the forefront of a transformative era in finance. With a deep-rooted expertise in market trends and talent acquisition, we’re witnessing firsthand the profound impact of cryptocurrency on the financial sector. This groundbreaking field is not only revolutionizing the financial landscape but also setting new benchmarks for the responsibilities and aspirations of financial executives. In this discussion, we explore the promising outlook for 2024, examine the prevailing market attitudes toward cryptocurrency, and consider how the role of CFOs is changing in a world where crypto integration is growing.

The Dawn of a New Era

As we move into 2024, the landscape of cryptocurrency is witnessing a shift. The previous bear market, characterized by skepticism and caution, has given way to a burgeoning bull market. This shift is not merely about rising prices but represents a broader optimism and a readiness to deploy capital into innovative ventures. The power of the internet to create leading businesses of our time is undeniable, and crypto, despite being in its early stages, is poised to follow a similar trajectory. Certain forward-thinking companies are already harnessing this potential, signaling a broader market awakening to the opportunities presented by cryptocurrency.

Market Mood and the 4-Year Cycle

The crypto market, known for its volatility, operates in a quasi-predictable four-year cycle, closely tied to the halving events of Bitcoin. This cycle, marked by fluctuations between bear and bull markets, is a critical indicator of market sentiment and investment strategy. The transition to a bull market suggests a growing confidence among both candidates and clients in the transformative power of crypto. Predictions for Bitcoin and other cryptocurrencies are increasingly optimistic, fueled by media coverage and a reassessment of cryptocurrency’s role within the financial sector.

Future Hires: Crypto-Ready CFOs

Executive Search Strategy for a New Financial Era

The evolving dynamics of the crypto market necessitate a new breed of financial executives — those who are not just familiar with cryptocurrency but are adept at integrating it into traditional financial operations. The search for these crypto-ready CFOs is a nuanced process, focusing on identifying leaders who can navigate the complexities of cryptocurrency, from regulatory challenges to its implications on corporate finance.

The Evolving Role of the CFO

The CFO’s role is undergoing a significant transformation. No longer limited to traditional financial stewardship, CFOs are now expected to be at the forefront of technological adoption, incorporating crypto into their companies’ financial strategies. This includes everything from managing crypto assets on the balance sheet to leveraging blockchain for operational efficiencies. The future CFO must possess a deep understanding of crypto markets, regulatory environments, and the strategic foresight to harness crypto’s potential for competitive advantage.

Incorporating Crypto: Strategy and Operations

Beyond the Balance Sheet

Incorporating cryptocurrency into a company’s financial strategy extends beyond merely listing it on the balance sheet. It involves a comprehensive approach that includes risk management, regulatory compliance, and the exploration of crypto-based revenue streams. CFOs will need to develop strategies for crypto holdings, considering volatility and the potential for significant impact on the company’s financial health.

Enabling Crypto in Business Operations

The integration of crypto goes beyond financial management; it also encompasses operational innovation. This could mean adopting blockchain for enhanced security and transparency in transactions or exploring crypto payments to open new markets and customer segments. The CFO’s role will be pivotal in driving these changes, requiring a blend of technological savvy and strategic vision.

Conclusion: Leading the Charge into the Future

As we stand on the brink of a new era in finance, the role of executive search firms like Key Search becomes ever more critical. Identifying and placing crypto-ready CFOs and financial executives is not just about filling a position; it’s about shaping the future of businesses in a rapidly evolving financial landscape. The optimism for 2024 and beyond is palpable, and with the right leadership, companies can navigate this new terrain with confidence and foresight.

We at Key Search are excited about the possibilities that lie ahead and are committed to leading the charge in this new financial frontier. If you’re a financial executive eager to explore opportunities in this dynamic field, or a company looking to innovate your financial strategy with crypto, we invite you to engage with us. Let’s explore together how we can transform challenges into opportunities and set new benchmarks for success in the digital age.

Some Data

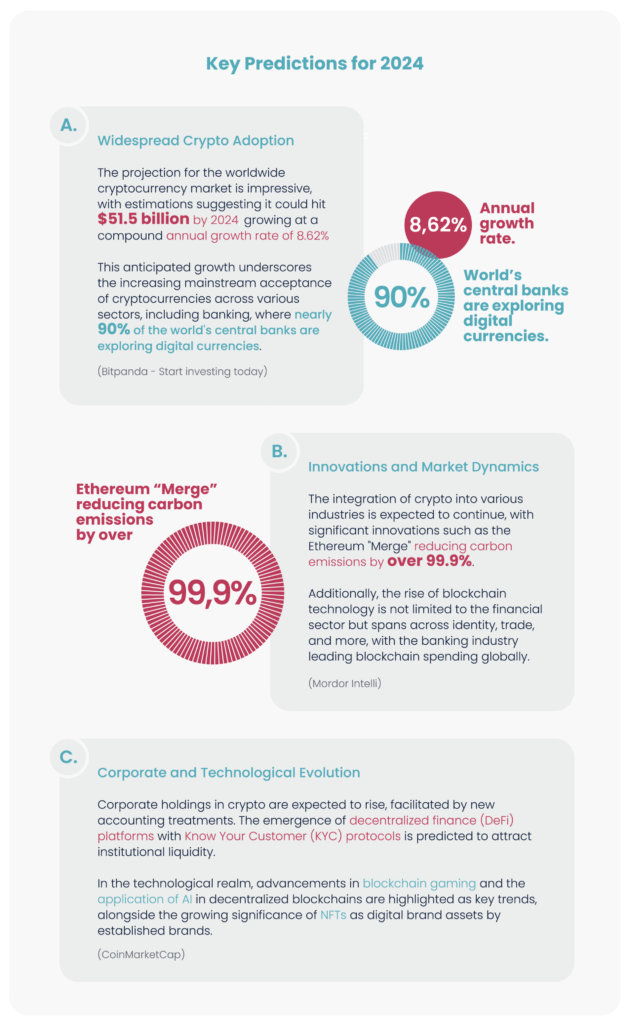

The landscape of cryptocurrency and its integration into the financial world is witnessing significant momentum, promising a transformative impact on the future roles of financial executives. This optimism is buoyed by a series of forecasts and trends that paint a picture of a rapidly evolving digital finance arena.

Cryptocurrency Market Overview:

The cryptocurrency market is characterized by its diversity, with segments including coin product developers, mining services, cryptocurrency exchanges, and wallet companies. The landscape is continuously shaped by mergers and acquisitions, technological innovations, and evolving regulatory frameworks. Despite the volatility and regulatory uncertainties, the market is driven by a rising demand for operational efficiency, transparency in financial systems, and increasing remittances in developing countries. However, it also faces challenges such as varying government regulations and the inherent market value volatility (Mordor Intelli).

For financial executives, particularly CFOs, these trends underscore the necessity for a robust understanding of cryptocurrency’s role within corporate finance. The ability to navigate these changes, from incorporating crypto assets into balance sheets to leveraging blockchain for operational efficiencies, will be critical. Moreover, the predictions for 2024 highlight the strategic importance of embracing crypto innovations, regulatory changes, and technological advancements to stay competitive in the rapidly evolving digital economy.

Thus, as we look towards the future, it’s evident that the role of financial executives will increasingly intertwine with the advancements in the crypto and blockchain spaces, setting a new paradigm for financial leadership in the digital age.