The Benefits of LTIPs for Startups

Long-term incentive plans (LTIPs) are increasingly popular among startups as a way to incentivize and retain key employees.

LTIPs offer numerous benefits for startups, from helping them attract top talent to increasing productivity and loyalty in the workplace. By offering their employees equity in the company through an LTIP, startups can create a sense of ownership which leads to greater commitment from employees who have a vested interest in the success of the business.

Additionally, it gives startup founders more control over how they allocate resources and provides investors with increased transparency into how capital is being used. With all these advantages, we’re taking a closer look at the types of LTIPs and how they can provide valuable incentives that help promote long-term growth for both employers and employees alike.

What is a Long-Term Incentive Plan?

The recipient of an LTIP is usually an executive or senior executive at a company. To be eligible for executive compensation, meaning the startup’s long-term incentives, these employees are expected to meet a range of conditions or requirements.

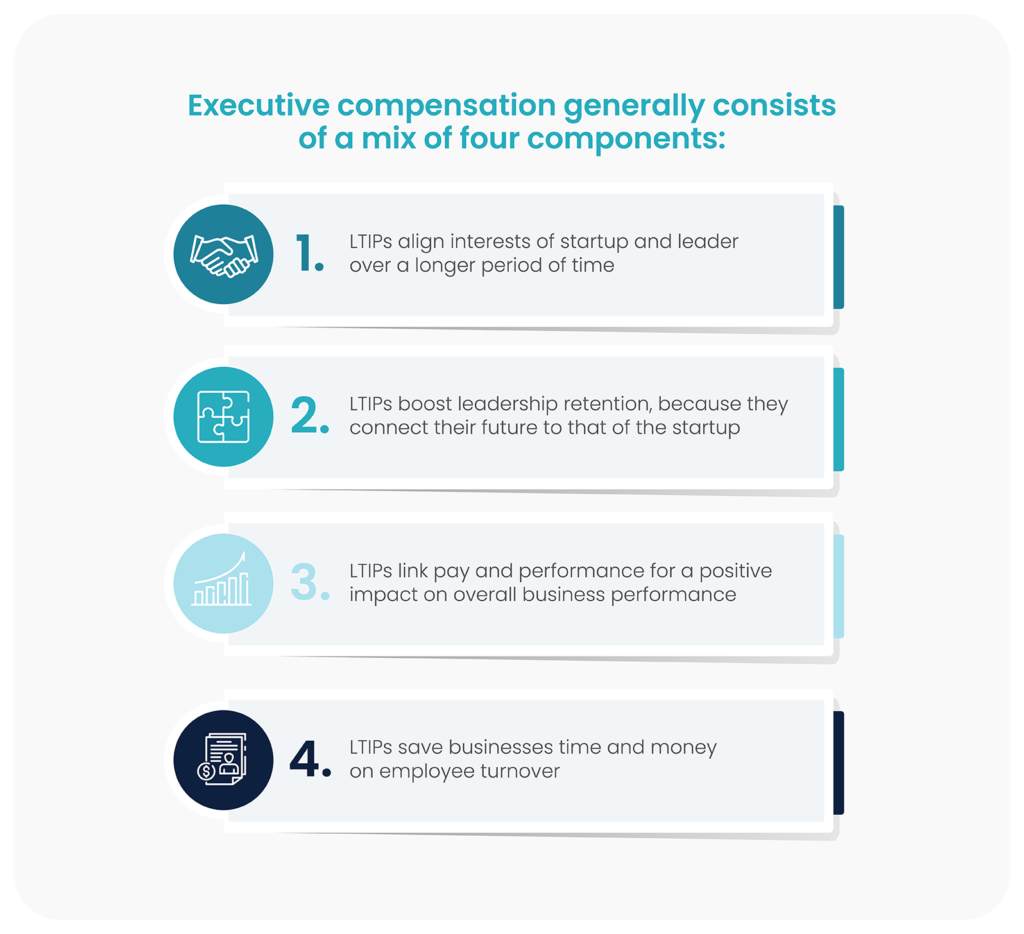

The benefit of a long-term incentive plan is that it creates a longer, more committed partnership between the employee and employer. A common deferred compensation strategy for senior leaders, LTIPs can account for up to 60% of executive compensation according to research by Deloitte. This makes them one of the four pillars of the executive compensation structure:

Long-Term Incentive Plans Examples

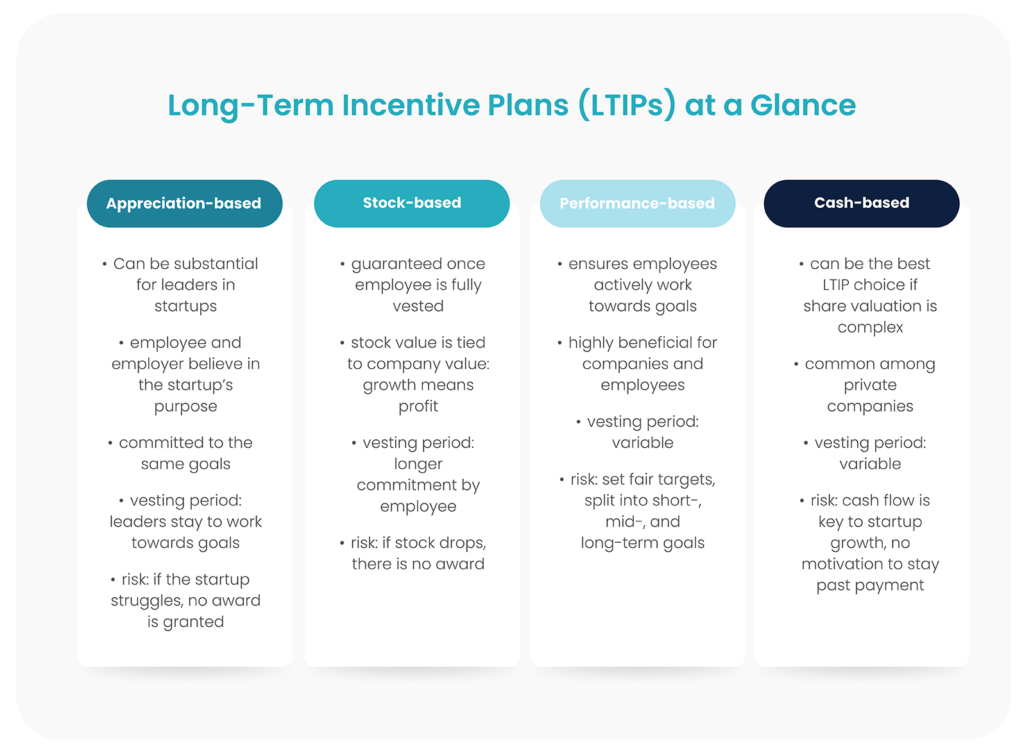

A range of LTIP options is available as part of the executive compensation package for senior leaders beyond the base salary.

Examples of LTIPs

Matching Contributions: a time-based LTIP where an employer matches a percentage of an employee’s contribution to the company’s retirement plan up to a certain contribution amount. It can take several years before this benefit takes effect.

This duration is called the vesting period, the timespan an employee has to wait before receiving full ownership of this long-term incentive. Typically, the company retains parts of its contribution until the employee is fully vested, when they own all retirement plan contributions.

Equity-Based Compensation: a performance- and time-based LTIP that is particularly beneficial for startups, because it offers senior leaders a portion of the business. In addition, equity compensation allows the employer to offer the employee financial incentives that won’t affect the startup’s bottom line and its initially limited cash flow.

Equity-based compensation can take various forms but at its core, employees are awarded full ownership of this equity after staying with the company for the predetermined timespan.

Cash Bonuses: cash-based LTIPs are common among private companies as they avoid dilution of ownership as well as equity-related complications such as share valuation.

Stock Options: an appreciation and time-based LTIP that is granted after a set vesting period or a cliff vesting date after which the long-term incentive is owned by the employee.

Another way of giving stock options to employees with a focus on creating a time-based LTIP is to give gifted stock, which the employee only receives and owns after the vesting period, often a 3-5 year period, has passed.

Employee Stock Options (ESO) at a Glance: Stock options for employees are available in different long-term incentive equity compensation plans. According to Investopedia, ESOs may include one or more of the following stock options:

- Restricted Stock Units (RSUs): employees have the right to acquire or receive stock once criteria, such as the vesting period or performance milestones, are met.

- Stock Appreciation Rights (SARs): this stock option provides employees with the right to the increase in value, the appreciation, of a predetermined amount of shares. This increase is paid in cash or company stock.

- Phantom Stock: equal to a fixed number of shares, a future cash bonus will be paid to the employee, omitting the otherwise necessary legal transfer or share ownership.

- Employee Stock Purchase Plans (ESPP): allow employees to purchase company stock at a discount, with the employer paying the balance. These stock options are usually non-transferable, meaning only the employee can use them. The amount of stock options can increase with an employee’s seniority level in the company.

Benefits of LTIPs for Startups

Long-term incentive plans are beneficial for both employees and employers as a deferred compensation strategy. For startups, but also bigger companies and global organizations, LTIPS come with many benefits for employees and employers.

The Positive Impact of Management Incentive Plans

We have summarized the positive impacts of LTIPs for startups that are looking to hire their leaders at a glance:

How do you attract the leader you need to help you grow your scaling startup? How do you find, attract and retain the leader you need to start or grow your startup’s executive team?

In a market where top talent is in high demand, it is important to work with a reliable and experienced executive search firm and attract senior leadership talent with the right offer. Key Search understands the demands of today’s Executive Search process and can help you find and hire the very best candidate for your leadership position.

Because we help some of the world’s most exciting startups and fast-growth companies hire their leaders, it would be our pleasure to take you through our process and discuss your hiring needs in a first meet and greet call. Let’s talk and discuss how we can help you hire your leaders.