Contents

As the world becomes more digital, it’s no surprise that central banks are exploring the possibility of issuing their own digital currencies.

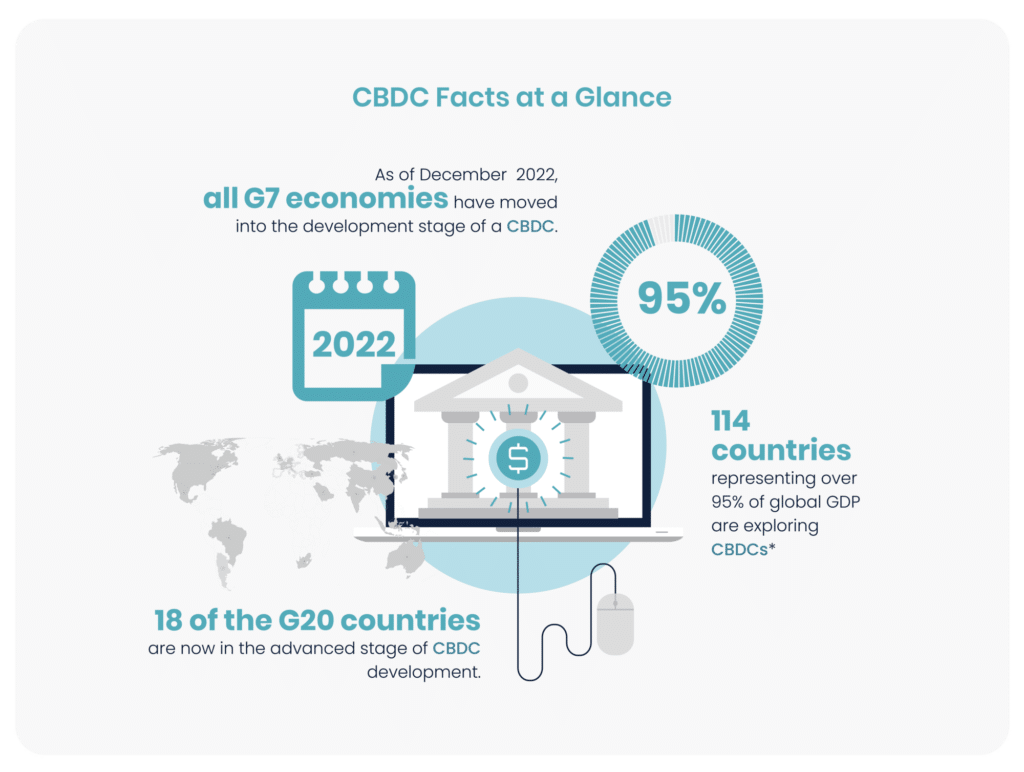

Central Bank Digital Currencies (CBDCs) have been in the works for a few years now, but it’s only in the past year that they’ve gained real traction, with several countries announcing that they are exploring or testing CBDCs.

But what exactly are CBDCs and why are they receiving so much attention? In this article, we take a closer look.

What are Central Bank Digital Currencies (CBDCs)?

CBDCs are digital versions of a country’s fiat currency that are issued and backed by the central bank. They are designed to be a safe, secure, and convenient way to make payments, just like cash or bank deposits.

There are two main types of CBDCs: wholesale and retail. Wholesale CBDCs are only available to financial institutions and are used for settling large-value payments between banks. Retail CBDCs, on the other hand, are available to the general public and can be used for everyday transactions like buying groceries or paying bills.

What are the benefits of CBDCs?

Why are CBDCs gaining more and more attention? There are several reasons why central banks and financial institutions around the world are researching or piloting the use of CBDCs for financial transactions.

- CBDCs could potentially improve the efficiency and security of the payment system. As a digital alternative to cash, CBDCs could reduce the cost and time of making payments, and provide greater security against fraud and counterfeiting.

- CBDCs could help to address some of the challenges of private cryptocurrencies, such as Bitcoin. While these offer many benefits, their potential risks include volatility, lack of regulation, and potential use for illicit activities. Government-backed CBDCs could offer many of the same benefits while mitigating some of the risks.

- CBDCs could be used for online and offline transactions and can be integrated into existing payment systems in national and cross-border payments.

- CBDCs could help to promote financial inclusion by providing a digital alternative that is safe and accessible. This way people who don’t have access to traditional banking services can store and transfer money.

What are the Challenges of CBDCs?

While CBDCs offer many potential benefits, there are also several challenges that need to be addressed.

One of the main challenges is ensuring that CBDCs do not pose a threat to financial stability. CBDCs could potentially disrupt the existing banking system if they are not implemented carefully.

Another challenge is ensuring that CBDCs are secure and resistant to cyber attacks. Central banks will need to invest heavily in cybersecurity to ensure that CBDCs are safe to use.

Finally, there are concerns about the impact of CBDCs on the privacy of users. Central banks will need to find a balance between providing a secure and transparent payment system and protecting the privacy of users.

Why do Governments Explore Digital Currencies?

Governments have many reasons to explore digital currencies. Different countries have different motivations for exploring or issuing CBDCs and they all depend on a country’s economic situation.

According to the Atlantic Council’s CBDC tracker, some common reasons are:

- promote financial inclusion within the country

- provide easy and safer access to money for unbanked and underbanked populations in rural areas

- introduce competition and resilience in the domestic payments market

- provide cheaper and better access to money

- increase payment efficiency and lower transaction costs

- create programmable money and improve transparency in money flows

- provide for the seamless and easy flow of monetary and fiscal policy

Hiring Leaders for CBDCs

With the rise of digital currencies, financial institutions will need to adapt and develop new capabilities in areas such as blockchain technology, cybersecurity, and data analytics. This means that there will be a growing demand for skilled professionals with expertise in these areas.

The CBDC industry is still in its early stages, but it is growing fast. CBDCs are built on blockchain technology, which requires specialized and rare-to-find technical expertise. This, together with a limited pool of talent with experience in this area, makes it challenging to find leaders with the necessary skills, experience, and knowledge to drive success in the CBDC industry.

To stay ahead of the game and attract top talent in the emerging CBDC industry, Key Search will support you in finding and hiring leaders in those CBDC job areas.

With our expertise and extensive network at Key Search, we can help you find the best leaders for your organization and drive success in this rapidly growing industry.

Learn about Central Bank Digital Currencies (CBDCs) and their potential to reshape the future of money with Key Search. Examine the implications and opportunities of CBDCs. Discover how digital currencies can revolutionize financial systems and improve transaction efficiency. Stay ahead in the evolving financial landscape with our expert analysis.