How do you turn your start-up idea into a thriving business? Your idea has strong potential, because it answers a need or demand in your industry. But in order to turn your concept into a successful start-up, you need a clear action plan for growth, and to grow, you need funding.

“About 90% of startups fail, which means only 10% survive.”

Your action plan is a combination of your marketing strategy and an early vision of your business plan, validated through your research and industry knowledge. Through creating this action plan, your investment needs become apparent and your search for the right start-up investors can begin.

Identifying and approaching suitable investors with a convincing pitch deck to secure capital for business growth and scaling is the key to reaching milestones and advancing through the start-up stages.

Contents

Is your start-up ready for investors?

First things first. Beyond a great idea and a solid plan, you need to understand the exact start-up stage your business is currently at in order to find suitable start-up investors. Many invest at the seed stage, some even earlier. Different start-up stages require different funding rounds and investment amounts which means the start-up investors you approach may change from angel investors to venture capital firms. In addition, building a diverse mix of capital streams allows you to accelerate growth at every stage.

Investments at the concept and pre-seed stage

In the concept and pre-seed stages of your start-up, you validate and fine-tune your concept and develop your action plan into a marketing plan and business plan.

The initial capital is often provided by you and your close connections, often family, friends, and possibly a business friend. As your start-up grows, this approach becomes less feasible and the need to attract outside investors to reach milestones becomes the new priority.

Investments at the seed stage and beyond

When evaluating your start-up’s next milestone, it becomes apparent that you need enough working capital to reach it. Performing essential tasks that help you reach your next milestone may mean, for you as a founder, that you are hiring key management positions, performing research, or refining the prototype – your start-up is at a point where the need for start-up capital surpasses your private funding capacities.

Looking beyond the near-future goal, different start-up stages require different funding rounds. For each, the amounts of investments vary. Building a diverse mix of start-up capital streams early on allows you to accelerate growth at every stage while finding suitable investors for your start-up. Whether it’s sustaining strong growth, scaling the business, or expanding into a new market, growing your business means having access to sufficient start-up capital. Understanding the different types of investors and acquiring the best investors for your start-up is essential to remain on a successful trajectory. This means it is time to understand how to find the right investors for your business.

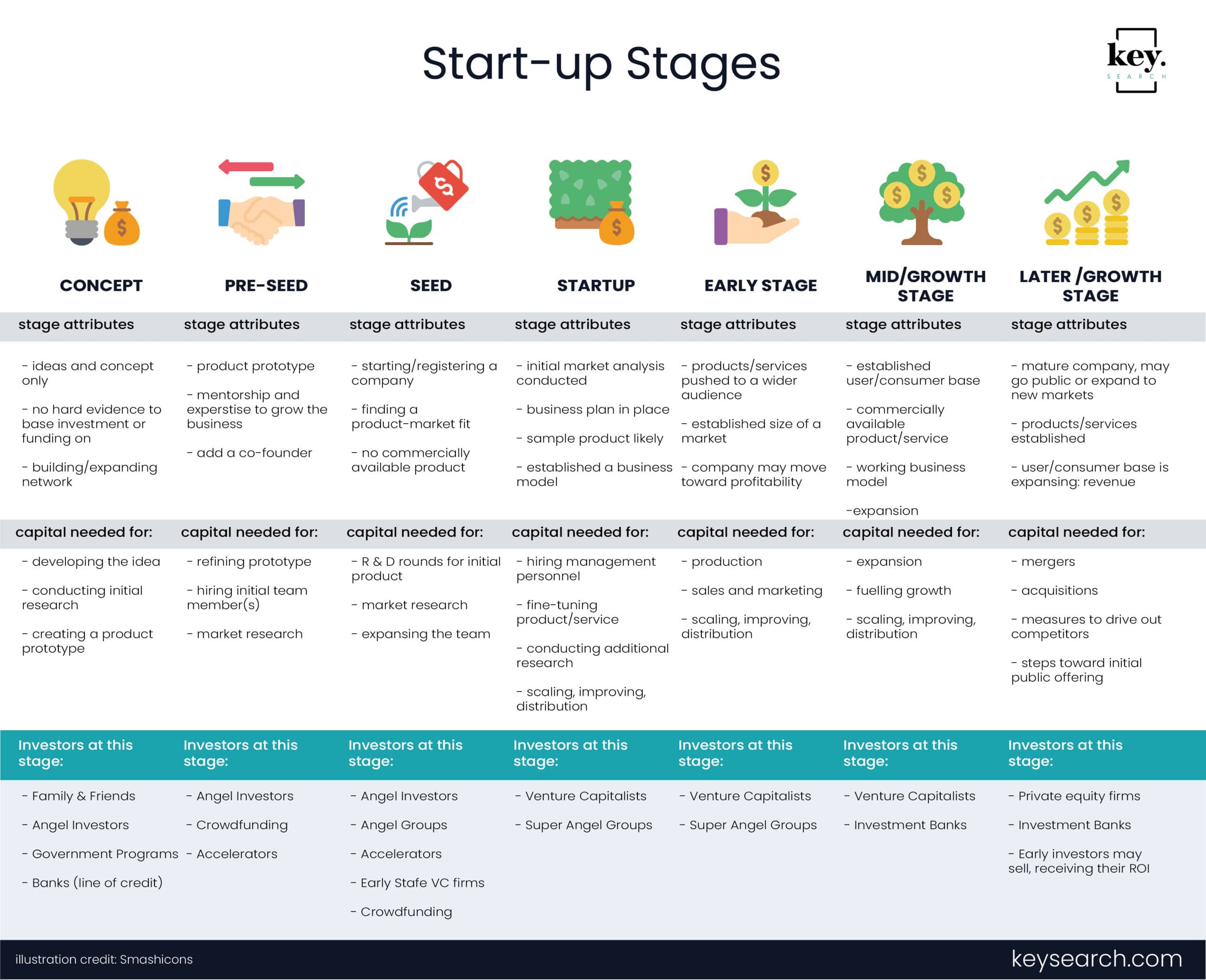

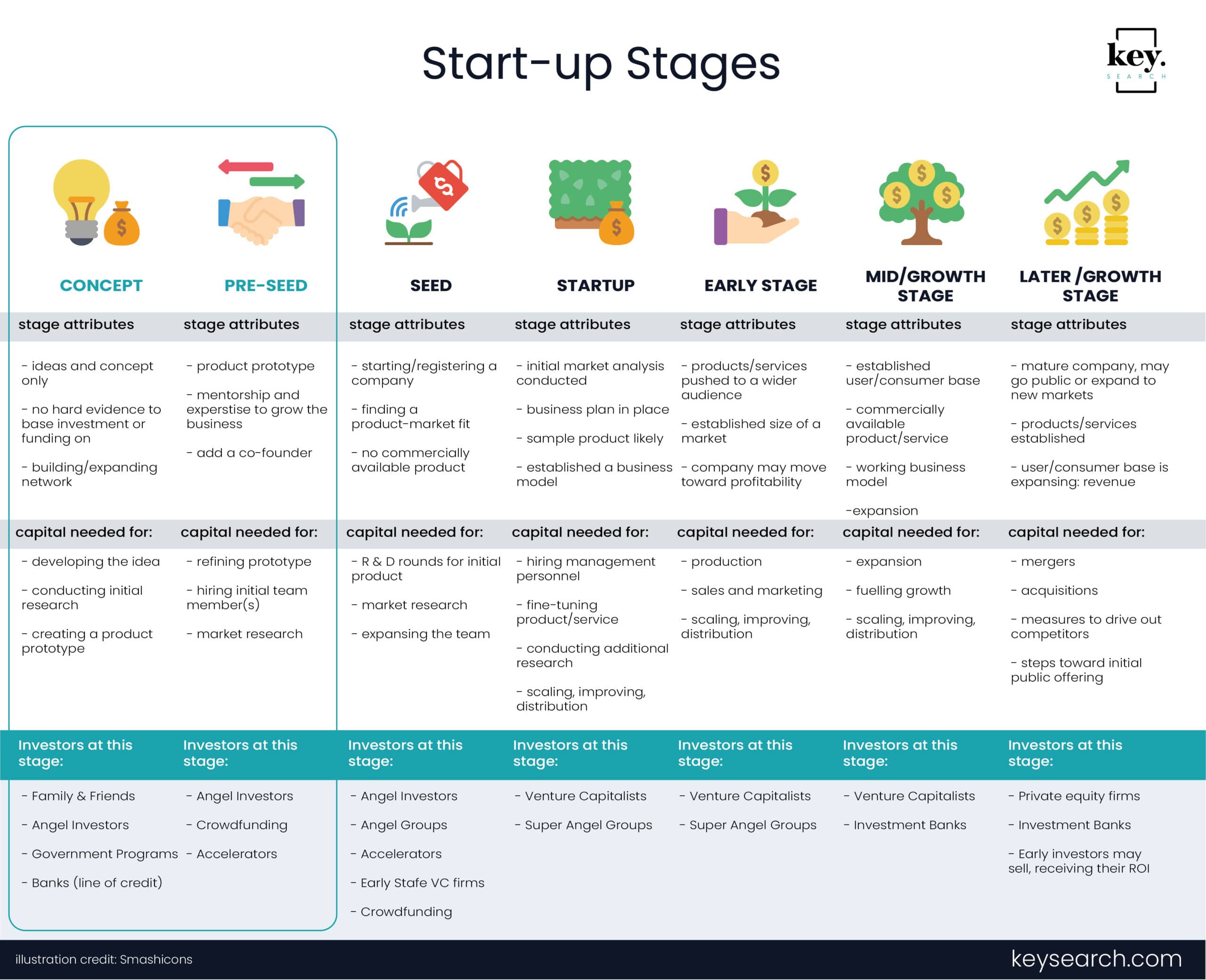

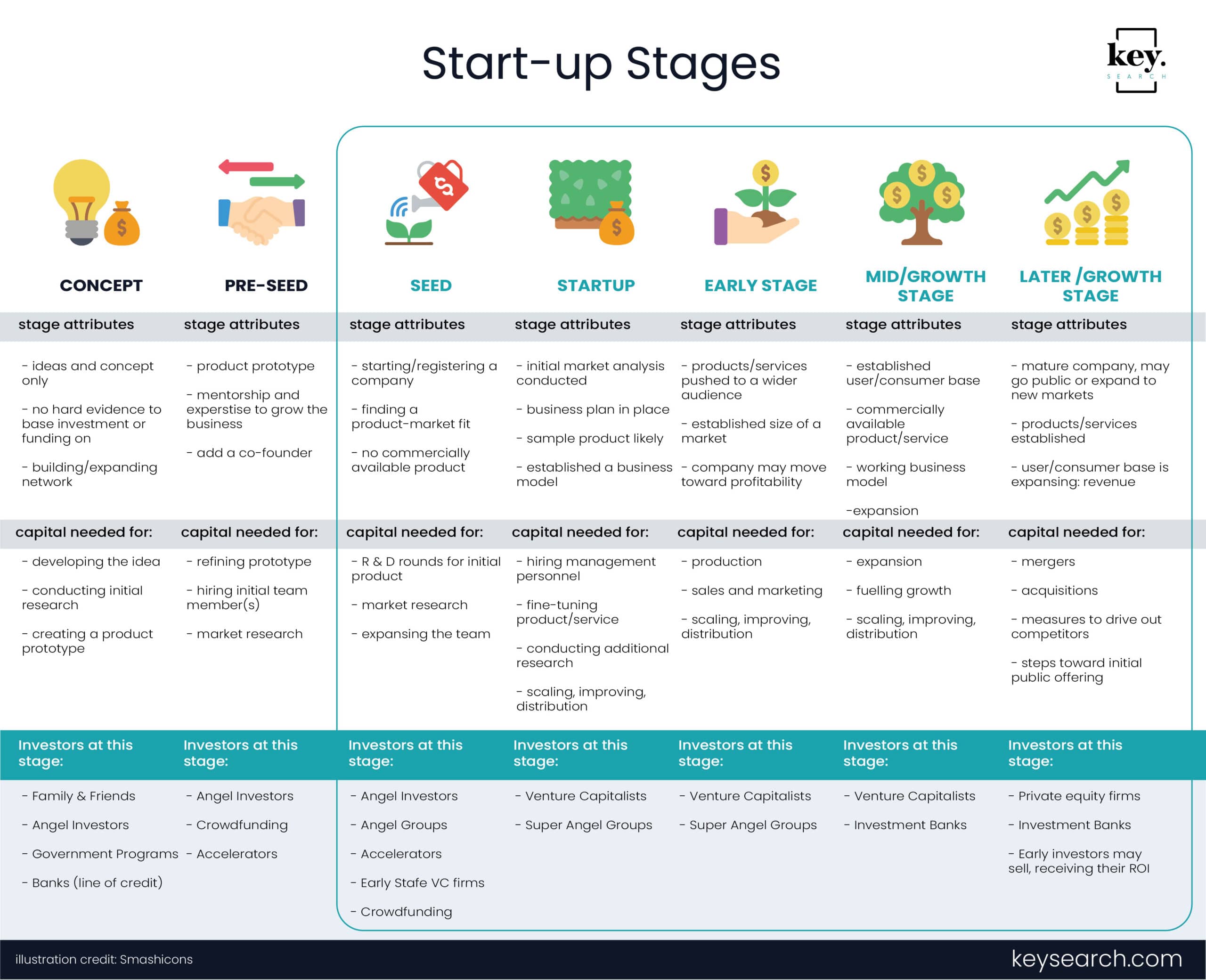

The following graphic is an overview for you to identify the development stage of your start-up and the investors to approach at each stage. It covers the following:

Start-up stages: key stages a start-up travels through from concept to growth stage.

Start-up stage attributes: a list of facets common for a particular start-up stage.

Start-up investors by stage: the types of start-up investors that are best to approach at each stage.

Start-up stages, attributes and investors at a glance

How to find the right start-up investors

Once you have identified the stage you are at and the appropriate type of investor for your stage, your industry, and your idea, you have all facts needed to start creating a list of potential investors.

Your start-up in the concept and pre-seed stage

In the concept and pre-seed stages, you are launching your start-up. Research which types of investors are best suited to raise the funds and gain the visibility you need for your next start-up stage.

Attending industry events early on allows you to network and get noticed by potential investors. Setting up an online presence including social media and a blog for your business is another crucial step in the early stages of your start-up to add more visibility.

Accelerator programs can be a good fit for your company, if you are interested in more than start-up capital. These offer business advice and mentorship, are cohort-based and culminate in a pitch day or demo event. Additionally, accelerators help you expand your network in your industry and if you are seeking help in staging future fundraising rounds, these can be a good fit.

Various types of online fundraising platforms are a very popular way to receive start-up capital for your venture. From individual investors and angels to peer-to-peer lending and crowdfunding sites, these platforms can be powerful for raising money as well as getting noticed if you select the one that suits your business needs and campaign best.

The challenges of the concept and pre-seed stages can be summarized in the fact that you are a new business. You rely on your personal ability to pitch, convince and sell your idea prior to having a sample product. Adding a co-founder with a skill set that complements your own can be an important consideration.

Your start-up in the seed stage and beyond

From the seed stage onward, you are scaling your business. The investors you will be approaching at the seed stage are specialized in this stage and its funding rounds. Researching industry-specific investors for seed-stage funding combines access to more start-up capital with access to expertise and an extended network in your industry.

What all investors require from you to make a decision on providing venture capital for your start-up is a solid outline of your action plan in the form of a pitch deck. This includes your marketing plan and performance milestones, your finances, a business plan, and ROI targets, as well as long-term planning in the growth stage.

At this stage, the amount of venture capital needed often leads start-up entrepreneurs towards larger investment firms. Research is crucial to ensure you find VC investors that are a good match in terms of resources, network and support your vision for your start-up business to secure funding and support from.

The industry and geolocation of your start-up are two additional factors in determining the best investor for your business. Proximity fosters a closer business relationship including easy supervision with hands-on support and expert guidance between certain investors, such as angel investors, and their investment start-ups. Venture capital firms and other start-up investors will only invest in an industry they are experts in so they can evaluate the chance of your start-up becoming a success. In addition, for investors to be experts in your field means you are adding industry veterans to your network.

European Venture Capital Firms - a resource list

EMEA Venture Capital Firms

Venture Capital Firms for Start-ups by industry

How to approach and convince investors of your start-up

What does it take to convince start-up investors to support your business with start-up capital? The answer is simple and complex at the same time – a convincing pitch deck.

In the pitch deck, you create a presentation that outlines all aspects of your start-up, including:

- Concept – the idea

- Market research – the need/demand for your product or service

- Business model – the operational success of your start-up

- Business plan – the future objectives and how to reach them

- Long-term planning – the benchmarks, the ROI, the expenses

- Targeted consumers and markets – a growth vision and a plan

The goal is to convince venture capital firms – your well-researched, potential investors – of your start-up’s potential, and how much value you will bring to their investment portfolio. The challenge is to package this information into a start-up pitch deck that is very concise.

“Investors don’t look at pitch decks for very long –

just an average of 3 minutes and 44 seconds.”

Finally, at an investor meeting, presenting your start-up business and all the hard facts that go with it is only one aspect of selling your start-up idea. In addition, you need to have a deep understanding of your industry, because investors will ask questions. Know your market, your competition, the history of your industry and present a state of success and demand in your start-up’s field.

You may also like these posts:

Hiring your leadership team – one less thing for founders to take on

As the founder of a start-up, your to-do lists never cease to grow. In one particular area of managing the rapid growth of your business, however, the recruitment specialists at Key Search can help.

Whether you’re urgently looking to fill various leadership positions with top talent or are planning to hire the ideal candidate for your start-up’s first leadership position, Key Search will find the very best talent through our tailored executive search offering.

To help your growing company reach the next start-up stage, Key Search will seek out candidates that match your start-up’s needs. From industry experience to skill set, we will present a gender-balanced short list of highly qualified leaders and work together with you to choose the candidate that will bring exceptional value to your business.